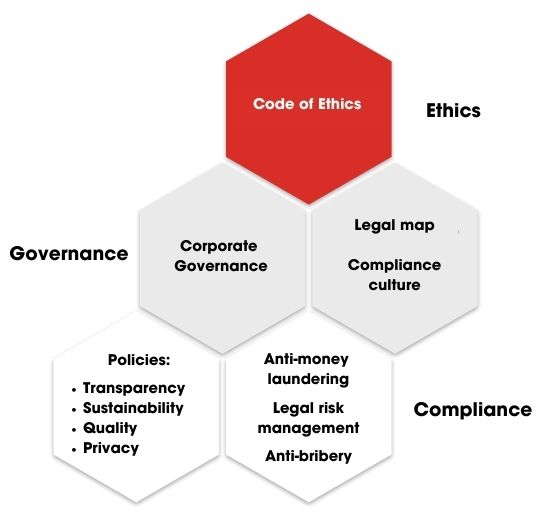

COFIDES is committed to an ethical and lawful management of its business activity and guided by the values which constitute its action framework, with the conviction that ethical conduct in business and good corporate governance practices go hand in hand with business and social success.

Thus, it promotes the values of excellence in the management of its activity with a clear commitment to quality, transparency and equal opportunities.

CODE OF ETHICS

The Code of Ethics covers not only the conduct that COFIDES expects from its staff, but also the Company's actions towards its stakeholders. Its objective is to serve as a code of conduct by establishing the values and commitments that should guide professional activity in the Company.

All the directors, senior managers and employees of the Company are obliged to be familiar with and comply with this Code of Ethics.

ANTI-FRAUD MEASURES PLAN

In accordance with the provisions of Article 22 of Regulation (EU) 2021/241 of the European Parliament and of the Council of 12 February 2021, which establishes the Recovery and Resilience Mechanism, as well as Article 6.1 of Order HFP/1030/2021 of 29 September, which sets up the management system for the Recovery, Transformation and Resilience Plan, COFIDES has approved the Anti-Fraud Measures Plan.

The Anti-Fraud Measures Plan contains various measures to prevent fraud, corruption, conflicts of interest and double financing. Its compliance by all the agents involved in the management of the funds of the Transformation, Recovery and Resilience Plan is essential to ensure that it is carried out with all the guarantees for the financial interests of Spain and the European Union.

ANTI-CORRUPTION

COFIDES is committed to regulatory compliance in the fight against corruption. The system is driven by the decision-making bodies of the company and covers all employees, managers and directors. In addition, it is a fundamental aspect of our regulations that, in projects financed with our own resources or those of others, the financed companies act with integrity and without engaging in bribery practices.

Since 2001, COFIDES has collaborated with the OECD National Contact Point in Spain, subscribed to the General Management of Trade and Investment, in the dissemination of the Anti-Corruption Agreement of Foreign Public Officials in International Commercial Transactions.

In 2005, COFIDES subscribed to the United Nations Global Compact initiative.

CRIMINAL RISKS

COFIDES has in place a Model of Organisation and Management of Criminal Risks in accordance with the requirements of the Criminal Code. COFIDES has a Compliance Unit which has ultimate responsibility in the interpretation and application of the Model, as well as the monitoring of the Channel of Complaints relating to breach or violation of the internal rules or infractions of the regulations which may be applicable.

PREVENTION OF MONEY LAUNDERING

With the essential objective of preventing the risk of money laundering operations, COFIDES has a comprehensive operational procedure in this matter which is outlined in the Procedures Manual on Prevention of Money Laundering and the Financing of Terrorism. It has a representative and a person authorised before the SEPBLAC (Spanish Executive Service of the Commission for the Prevention of Money Laundering and Monetary Offences), an Internal Monitoring Body (OCI in its Spanish acronym) and since 2015, a specialised Technical Unit.

PRIVACY

COFIDES ensures the confidentiality and security of the personal data that it processes with the implementation of security policies and the application of appropriate operational and technical measures. COFIDES, as Data Processor, has a Data Controller, a Security Manager, a specialised external Data Protection Officer and a Supervisory Committee.